Private equity funds are pooled investment vehicles that are raised from a group of sophisticated investors to pursue a specific investment strategy. Each investor in the fund makes a binding commitment to provide capital to the fund. Private equity funds are closed-end, meaning they have a finite life, typically 10 - 15 years.

A fundless sponsor is a group or individual seeking to identify acquisition candidates and negotiate acquisitions without having the equity financing required to complete the transaction upfront (hence, they are ‘fundless').

The term “sponsor” creates a distinction between the individual or group “sponsoring” the acquisition and the investors who are providing the capital. In a fundless model, the sponsor and the investors are distinct. Typically, with a private equity buyer, the sponsor and the investor are the same.

In this post, we are going to discuss the types of private equity and fundless sponsors and how they work:

Types of Buyers for Small Companies

There are generally two types of buyers for small companies:

Strategic buyers (like a larger competitor) and financial buyers (like Hadley Capital).

Financial buyers generally fall into one of two categories: Those with committed equity capital, and those without.

Hadley has committed equity capital. Our investors have made a binding, legal commitment to fund our acquisitions. When we find an attractive acquisition candidate we can invest in that company without outside approval.

Family offices are also a type of buyer with capital on hand to invest. Family offices are professional organizations that manage the investment and financial affairs for a single or multiple ultra-high net worth families. As part of a diversified investment strategy, some family offices will make investments in or acquire small companies.

In contrast, fundless sponsors typically must identify an investment opportunity and then raise the funds to complete the investment. Fundless sponsors go by many different names:

- Fundless sponsor

- Independent sponsor

- Search Fund

Fundless sponsor

Fundless sponsors identify acquisition opportunities and then raise capital to fund the acquisition.

There is a certain element of “chicken vs. the egg” in this type of process - it is difficult to raise money without an identified acquisition and it is difficult to secure an acquisition without capital in hand.

Some fundless sponsors raise all of the equity capital required to fund the acquisition from investors while other fundless sponsors contribute a portion of the equity from their own pocket.

The majority of fundless sponsors have done zero to one acquisition. However, there are some very established and capable fundless sponsors that have completed a dozen or more acquisitions.

The senior partners at Hadley started their careers as fundless sponsors completing four separate acquisitions. These acquisitions served as the track record to raise Hadley’s committed capital funds.

Getting started as a fundless sponsor can be as simple as starting an informal search for target companies, browsing deal listing sites, and connecting with business brokers and intermediaries that represent small companies.

The process can also be more formal and include establishing a company, naming it, building a website to describe yourself and your search, etc.

The profile of a fundless sponsor varies widely - from experienced executives to newly minted MBAs and all points in between. In general, search funds are often headed by younger executives who have recently completed an MBA. More senior, experienced executives tend to operate as fundless or independent sponsors because they often have the resources (time and money) necessary to be picky - both in terms of identifying a funding source and acquisition target.

Independent Sponsor

The term “independent sponsor” has more recently displaced the less-friendly “fundless sponsor” moniker. Independent sponsors have the same characteristics of a fundless sponsor and the terms can be used interchangeably.

Independent sponsors sometimes work with private equity funds or family offices as sources of equity capital. The combination of an independent sponsor and a funding source with committed or available capital can be mutually beneficial to both parties.

The independent sponsor gets a source of funding and the private equity firm or family office may benefit from the work done by the independent sponsor to identify a proprietary investment opportunity, organize a value purchase, or contribute operating expertise to the target acquisition.

Independent sponsors typically self-fund the process of identifying a potential acquisition candidate. At the closing of the acquisition, the independent sponsor often receives a closing fee.

The size of the fee will vary depending on the size of the transaction. After closing, the independent sponsor may receive a monthly management or monitoring fee or, if the independent sponsor endeavors to run the business full-time, a regular salary.

Search Funds

Another type of fundless sponsor is the search fund.

The two most common forms of a search fund are self-funded and sponsored searches.

Self-funded searches are essentially the same as fundless sponsors. The self-funded search is just that, self-funded, and is the most common search model. That is, an individual looking to “sponsor” an acquisition but without the “funds” to complete it without support from a third party. The entrepreneur bears all the costs to find a suitable acquisition target. Once a business is found to purchase, the searcher determines the best funding strategy for the acquisition.

Sponsored searches, also sometimes referred to as a “Traditional” search model, involves the searcher raising capital from investors to fund the search phase.

Expenditures in the search phase include searcher salaries, office space, travel expenses, and due diligence costs for a period of up to two years. Investors typically receive preferred equity in the acquisition equal to 1.5x their investment.

They also typically receive the right of first refusal to invest additional capital in the acquisition. But the investors are not committed, rather they have an option whether to invest, so a sponsored search is still fundamentally a “fundless” process.

Questions for Sellers to Ask a Fundless Sponsor

Fundless sponsors raise the equity required to fund an acquisition after they have executed a Letter of Intent to acquire a company.

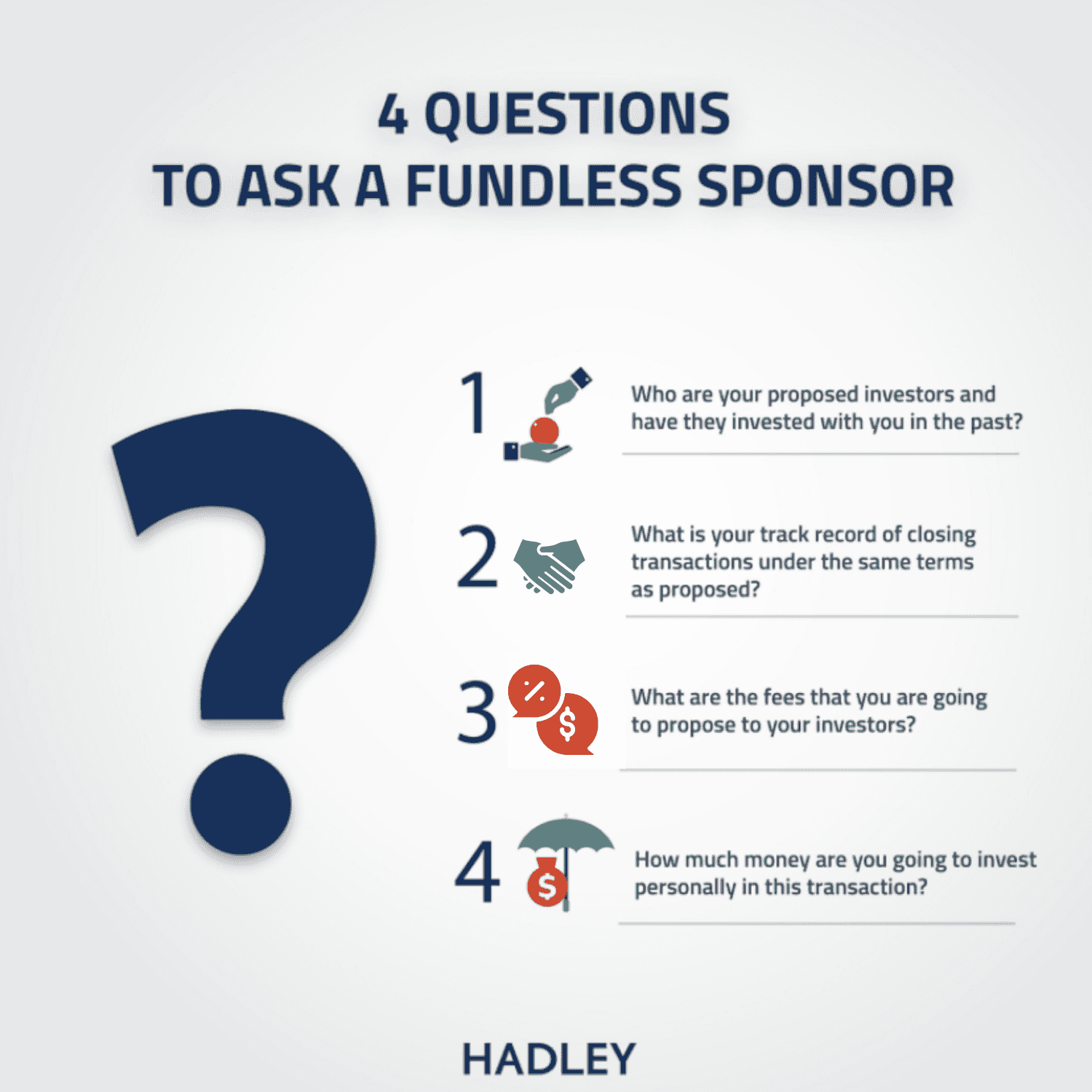

Since raising equity from investors is a notoriously difficult task, it is important for sellers to understand the likelihood that a fundless sponsor will actually close the transaction as proposed. Good questions to ask include:

Bradley Smith at Vertress lists some additional questions to ask fundless sponsors.

Hadley Capital has committed equity capital: We have the money. Alongside our own money, we raised it from wealthy individuals and institutional investors who have entrusted us with their capital. If you are a seller looking for a reliable, experienced, well-funded buyer, contact us today to see if we could be a good fit. Our calls are confidential and non-committal. Not ready to make a call? Learn more about our Easy Exit Evaluation.