The same intermediary who introduced the box game I described in my last post also referred me Jason Cohen's blog on the topic. Cohen sold his company back in 2007 and described his keep-it-versus-sell-it thought process in Rich vs. King in the Real World: Why I Sold My Company. If you are considering selling your company, but are just not sure as to when, you'll enjoy Cohen's post.

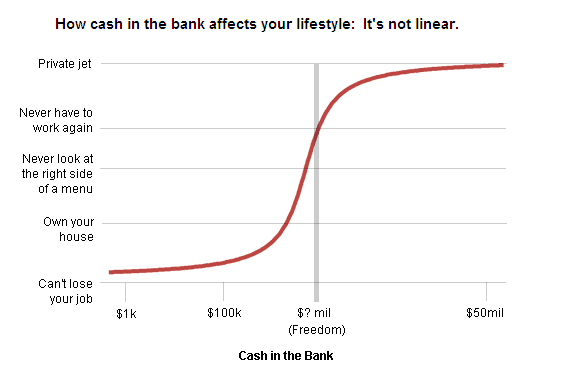

If you're not up for reading the entire blog and want a Cliff Notes primer, check out the chart below. It plainly and simply illustrates the benefits of cashing in now versus holding on for more. Locking in your gain by selling all or a portion of your company can be a life-changing event and, depending on where you fall on the $? Mil scale, holding out for more may not be worth the risk.