When the time comes to sell a small business, small business owners may engage a business broker to sell their business much like a homeowner hires a real estate broker to sell a home.

Some small business owners elect to sell their business without the assistance of a business broker which has some advantages and some disadvantages, as well.

In this blog, I’m going to cover the following:

- A Brief Overview of How to Sell a Small Business

- Five Success Criteria in Small Company Exits

- How to Sell a Small Business with a Business Broker

- How to Sell a Small Business without a Broker

How to Sell A Small Business: A Brief Overview

The first step in how to sell a small business is to ask yourself: Is now the time to sell?

Some of the reasons small business owners decide it is time to sell include: health problems, no more passion for the business, new interests outside the business, the owner is holding the business back, the owner lacks a transition plan, the owners’ spouse says it’s time to sell, the owner needs to diversify, and/or partnership differences.

If you find yourself in any of these positions, we’ve gone into greater detail about the questions you can ask yourself in another blog titled “Is It Time to Sell Your Business?”.

You can also take a look at the graphic below to identify some key factors:

Investopedia provides a nice outline on deciding whether it is time to sell and how to make plans to achieve a successful outcome that starts with asking yourself the reason why, considering the timing of the sale, getting a business valuation (consider using our Business Valuation Calculator to get an estimate in just 5 minutes), broker considerations, document preparation, finding a buyer, and handling the financial components.

Once the decision to sell has been made, the business owner needs to prepare the business for the sale process. At the most basic level, this involves making sure the financial records and operations are in order.

Want to know more about the details? The National Federation for Independent Business provides a robust checklist for preparing for a sale that emphasizes pre-qualifying a buyer and preparing an exit strategy in advance.

Over the past two decades, we have developed a simple framework to determine if a business is prepared for a successful sale.

Five Success Criteria in Small Company Exits

- Growth: Does the business exhibit stable historical growth? Is there a robust pipeline to support ongoing, near-term growth? Over the longer term, is there a well-defined strategy for future growth along with the related market opportunity?

- Team: Is the team complete, experienced and talented? Are they committed to the-long term growth strategy? Is there a shared mission and culture that drives the business and its employees on a day-to-day basis?

- Systems/Processes: Does the business leverage modern IT systems including an ERP system that integrates the functional areas of the business including operations, manufacturing, sales, marketing, and accounting? Are key business processes well-defined and documented to ensure ongoing operations are efficient?

- Competitive Advantage: What is the company’s source of sustainable competitive advantage? Are there substantial barriers to entry such as a proprietary product or service or some combination thereof?

- Quality Earnings: Are the annual earnings of the business highly repeatable? Is there good diversity in the sources of revenues and profits? Are gross margins and operating margins healthy? Is free cash flow high relative to operating profits (i.e. is CapEx relatively low)?.

The Five Success Criteria are a basic assessment that any small business owner can complete prior to selling a small company. A more comprehensive assessment of the business may also be appropriate if an owner is seeking to maximize the proceeds from a sale.

An additional key decision to be made when selling a small business is whether or not to engage the services of a business broker.

A business broker is an individual who assists in the sale of small (typically $5 million or less in revenue) or main street businesses (e.g. dry cleaners, convenience stores, etc.).

Many are affiliated with larger business brokerages (similar to a realtor affiliated with a large brokerage like Re/Max or Keller Williams) although some operate independently. Licensing requirements for business brokers vary widely from state to state.

Business brokers should not be confused with investment bankers who provide a wide range of capital raising, merger and acquisition advisory and other, more comprehensive capital markets services to larger businesses.

How to Sell a Small Business with a Business Broker

The decision of whether to hire a business broker to assist in the sale of a small business is highly dependent on the situation facing the small business owner.

We believe that hiring an experienced and competent broker tends to be a better route for most business owners than not. Small business owners are experts at running their business - they are not experts at understanding how to successfully sell a business.

Pros of Selling a Small Business with a Broker:

Avoid common pitfalls

Business brokers provide guidance to avoid common pitfalls in an often complex process: preparing the business for sale, marketing the business to potential buyers, navigating due diligence, negotiating a transaction, completing legal documentation and closing a sale is a complex process with many potential pitfalls. Having a solid guide in this process will benefit most small business owners.

Larger pool of buyers

Brokers maintain a network of potential buyers for small businesses and provide access to and markets the business to this network. Access to a larger pool of interested buyers is critical to identifying a potential match and to creating a competitive process that ensures that a seller achieves a successful outcome.

Industry knowledge and expertise

The best brokers will have a track record of successful transaction experience (backed up with references from buyers and sellers), experience in or knowledge of the industry in which your business operates, and the ability to provide a strict and detailed timeline for completing a transaction.

Identifying and hiring a good business broker is no different than selecting any other vendor - and small business owners tend to be experts at the process of selecting vendors.

Buffer between seller and buyer

Maintaining a positive relationship between seller and buyer is important to getting a transaction across the finish line, particularly if the seller will work with the buyer after the transaction closes. A business broker can often serve as the go-between between buyer and seller.

Network of experts

A successful sale process involves the input of a variety of specialists beyond a business broker. Brokers will frequently organize a group of specialists including experienced transaction attorneys, tax advisors, and estate planners, among others that will assist in completing a transaction and deal with thorny pre-closing and post-closing transaction-related issues.

For example, brokers, transaction attorneys and tax advisors will frequently work together to ensure that a seller can minimize tax related to the sale of the business.

Cons of Selling a Small Business With a Broker:

Cost

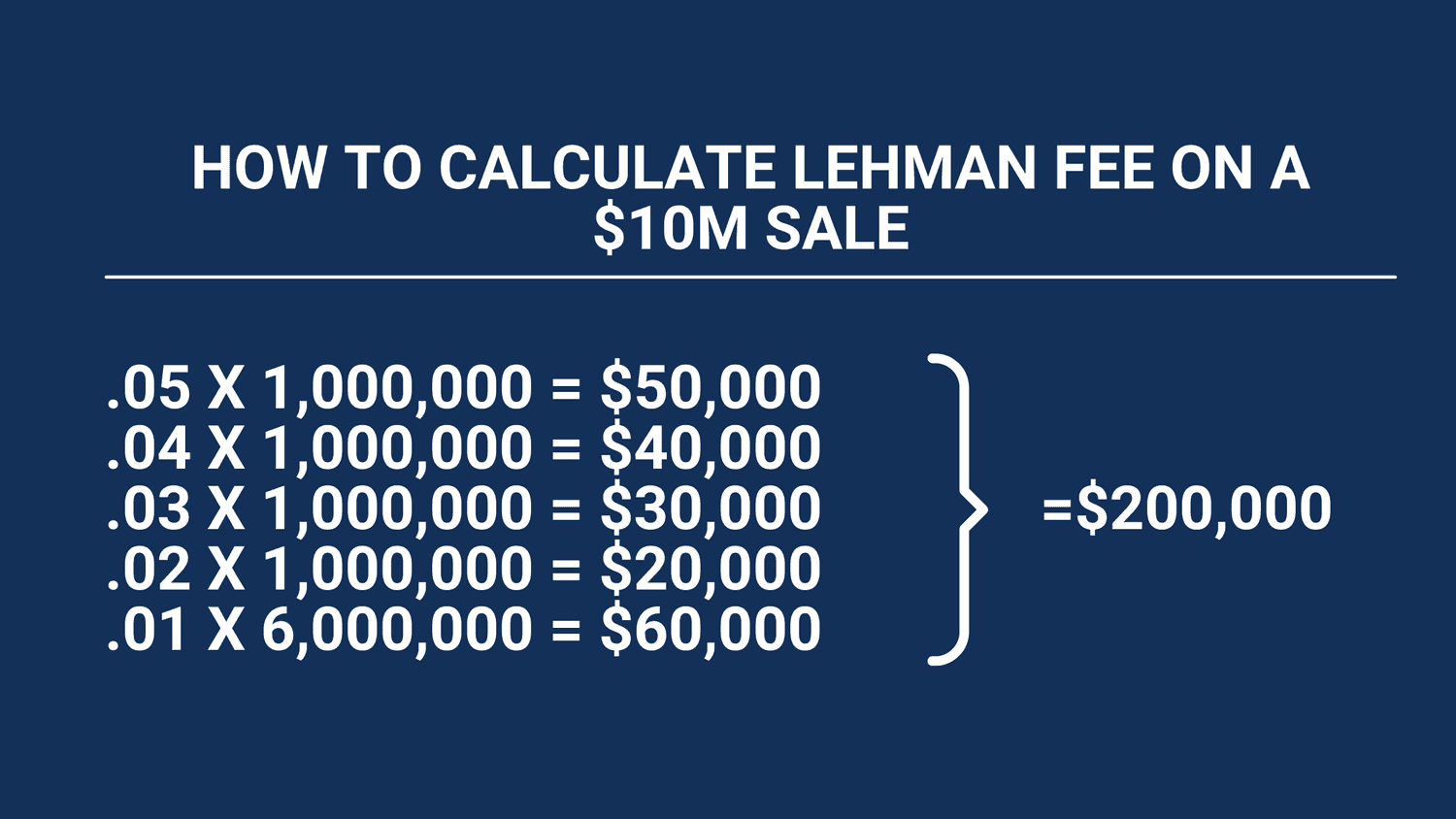

A standard broker fee or commission is typically based on a Lehman Fee structure. The Lehman Fee structure was developed by Lehman Brothers and is the most common fee structure in small company mergers and acquisitions. We wrote an additional blog post covering The Lehman Fee structure that you can read here.

The Lehman Fee is calculated as follows:

- 5% of 1st million of proceeds

- 4% of the 2nd million

- 3% of the 3rd million

- 2% of the 4th million

- And 1% of the remainder

So, for clarity, a $10M sale results in a $200,000 fee. Take a look at the visual below:

Some brokers may charge a flat fee structure, like 3%. In nearly all cases, brokers will request an advance against the final fee or commission in order to cover certain costs and expenses as well as to confirm the selling party is committed to the sale process.

Loss of Control

Hiring a broker requires a business owner to trust that the broker will run a structured process that accurately conveys the business to the market. For some business owners, this loss of perceived control over a critical next phase of their business is extremely difficult to imagine.

Misaligned Incentives

Just like in the sale of a home, a broker has an incentive to get-a-deal-done so they get a fee or commission. Business owners must be aware that this misalignment of incentives exists and that a bad deal for the seller can be a good deal for the broker.

How to Sell a Small Business without a Broker

As stated above, we believe that hiring an experienced and competent broker is typically in the best interest of most small business owners looking to sell their business.

However, many small business owners successfully sell their businesses without the services of a business broker.

These cases generally fall into a few buckets:

- The business owner is approached directly by a buyer without actively marketing the business for sale.

- The business is being sold to a family member.

- One partner in the business is selling to another partner in the business.

- There are a handful (or fewer) of extremely logical and motivated buyers for the business.

- Some business owners feel that there is no one more qualified to market and sell their business than them!

For anyone facing any of the situations listed above, here are the pros to consider when selling without a broker.

Pros of selling a small business without a broker:

- Lower Cost

- More Control

- Avoid Misaligned Incentives

- Avoid Bad Brokers

It’s “cheaper”

Without the services of a business broker, the small business owner can avoid a transaction fee or commission as described above.

Retain control

Many small business owners are used to being the complete and sole authority on important decisions related to their business.

Working with a business broker can be uncomfortable for some small business owners because it requires them to rely on a third party to effectively communicate with buyers about their business. Who knows my business better than me?

Avoid misaligned incentives

Just like in the sale of a home, a broker has an incentive to get-a-deal-done so they get a fee. A bad deal for the seller can be a good deal for the broker.

Deciding not to work with a broker can eliminate the concern that the broker does not have the business owners’ best interests in mind and ensures that the seller has their own best interests in mind.

Not all brokers are created equal

Picking a bad broker can be costly in terms of time and money.

Cons of selling a small business without a broker:

- Casting a Narrower Net

- No Network of Experts

- Additional Research Required

- Lack of Buffer

- Substantial Time Investment

Casting a Narrower Net

A successful broker should be able to create a broad market for the business by identifying and communicating with many buyers.

Without the support of a business broker, a small business owner may limit the number of potential buyers and, thus, forgo the opportunity to create a situation where multiple bidders are competing to buy the business.

No Network of Experts

A successful sale process involves the input of a variety of specialists beyond a business broker. Without the Rolodex of a successful business broker, a business owner will be required to pull together their own group of specialists including experienced transaction attorneys, tax advisors, and estate planners, among others.

Additional Research Required

A good business broker will provide advice to a seller on expectations for business valuation, required terms of a sale, and other important market knowledge.

Selling a business without a business broker will require a seller to develop this knowledge putting in the time and effort to learn the market themselves.

Lack of Buffer

Maintaining a positive relationship between seller and buyer is important to getting a transaction across the finish line, particularly if the seller will work with the buyer after the transaction closes. A business broker can often serve as the “bad guy”/go-between between buyer and seller.

Substantial Time Investment

Most small business owners will only sell their business one time. They are not experts in the process.

Managing a sale process without a business broker will require a significant time investment by the business owner to search for potential buyers, prepare a summary overview of the business, discuss the opportunity with identified buyers, prepare due diligence materials, etc. And, the time and focus spent on the sale process limits the owners’ time spent focused on running the business.

Conclusion

Choosing to use a broker when selling a business is a big decision that requires weighing both the pros and cons. Every situation is unique and there is no one-size-fits-all answer.

Hadley has acquired small businesses represented by business brokers and small businesses where the business owner did not use a business broker.

All situations are different. In the end, you tend to get what you pay for, and a good broker should more than pay for themselves.

If you are evaluating what’s next for your business and want to discuss navigating the sale process with or without a broker, please contact us.