Following the recent adversity felt by small businesses across the country, we are hearing from a lot of business owners regarding the future of their companies.

Developing an appropriate “exit strategy” is a critical element of owning any small business, regardless of when you intend on moving on.

Yet, this is not something small business owners readily revisit. We understand the emotional connection that many small company owners have with their businesses, and the idea of stepping away isn’t an easy thought to process or plan.

Excluding the emotional drainage of COVID-19, there are several reasons why business owners might be ready to sell: health problems, no more passion for the business, worn down by the day-to-day responsibilities, new interests outside the business, lack of a transition plan, a spouse says it’s time, a need to diversify more, and partnership differences, among others.

In addition to downplaying the negative connotation associated with an “exit”, this blog will address the following:

- What is an Exit Strategy?

- Why Have an Exit Strategy?

- Selling Your Business

- Other Exit Strategies

- Tips on Writing an Exit Strategy

What is an Exit Strategy?

An exit strategy addresses your eventual departure from your company and the means by which it is accomplished.

In light of other objectives such as retirement, spending time with family, looking for a change of pace, etc., an effective exit strategy also helps maximize your monetary goals.

An appropriate exit strategy is dynamic, reflecting the current situation of the business and adapting as necessary.

An exit should not be viewed as potential neglect of your company, rather in a positive light: creating a sense of security for you, your business, and your team as you gradually transition away.

Its goal is to help facilitate this transition while creating a sense of direction for the future of the business.

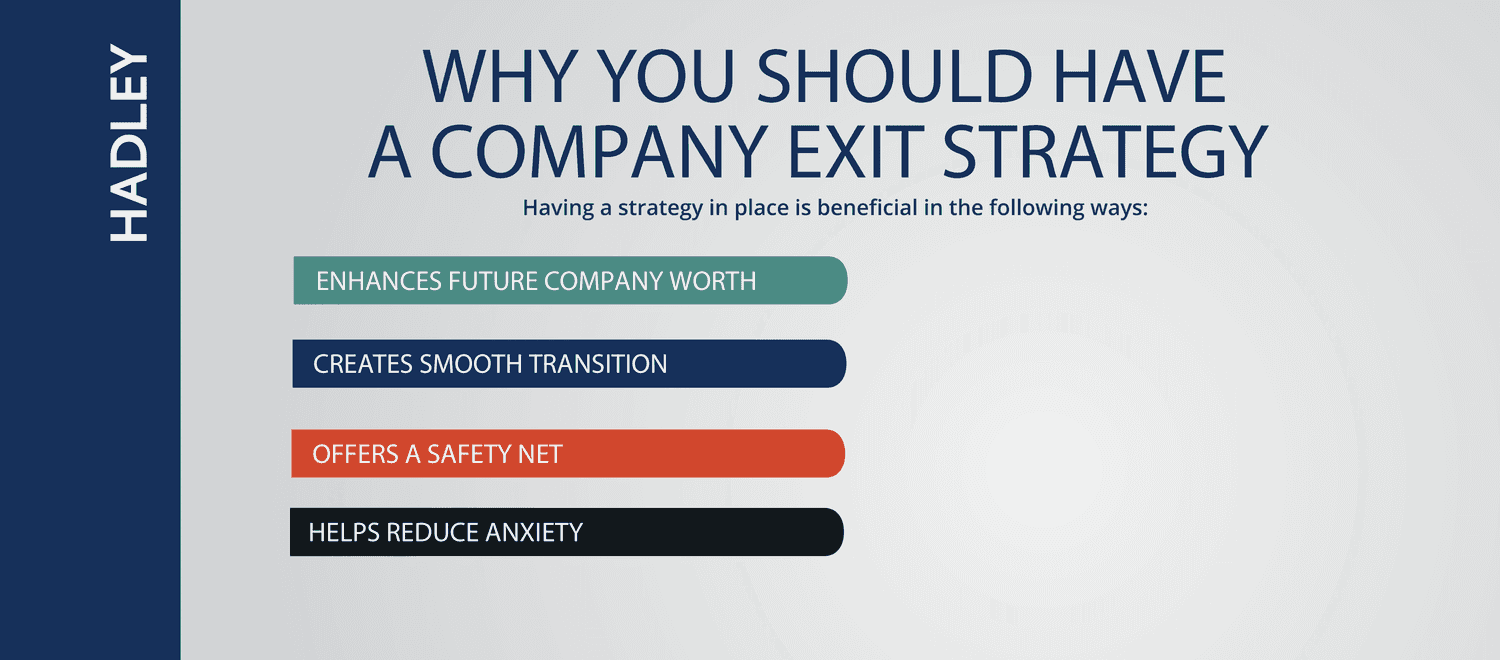

Why Have an Exit Strategy

Having a strategy in place is beneficial in multiple ways:

- Enhances Future Company Worth – A well-thought-out exit strategy addresses many of the risks associated with the transition of a small company from one owner to the next, increasing the company’s value.

- Creates Smooth Transition – An exit strategy allows your employees and management team to prepare for a new future, reducing the risk of any unexpected hurdles.

- Offers a Safety Net – As previously mentioned, an exit strategy is necessary regardless of when you plan on exiting the business. An active exit strategy also protects the business from unforeseen circumstances, such as incapacitation or an untimely death.

- Helps Reduce Anxiety – It is normal to feel stressed when envisioning your company without you in it. Knowing there is a plan in place following your departure can help mitigate the potential burden.

There are several pathways to support an exit strategy, including selling the business, creating an ESOP, merging with another company, going public, and although not ideal, liquidating it all together.

Selling Your Business

There are many reasons why a business owner might be hesitant about selling their business:

- Emotional Attachment – As previously mentioned, we understand the emotional ties an owner has with their company, which can delay the decision.

- Unknown Territory – Selling your business is a big step and approaching the process can lead to confusion about the process and frustration about how to proceed.

- Important Decisions – You have worked hard to get your company where it is today, and the thought of handing it over may be intimidating.

We frequently speak with small business owners who have these doubts, and there’s no question it can be an intimidating process.

With these in mind, we’ve identified common ownership transitions that need to be addressed in an exit strategy:

- Founder/Owner

- Family Transition

- Partnership Buy/Sell

- Sell to Management Team

Founder/Owner

Most small companies are owned and operated by a founder, so this transition tends to be most common when small business owners look to sell their business.

When you’ve been running a company for decades, your presence is often critical for the stability of the business. This presents a challenge when seeking an exit because the business may struggle to operate without you, negatively impacting the value of the business.

Put simply, your business won’t let you retire.

We phrase this as being at the crossroad of ownership transition and management succession.

Let’s say you have taken a less-active role in your business, and the management team has been running the company for quite some time. In this case, management succession is easy to accomplish because there’s little operational risk following your departure. This drives the value of your business up and allows successful ownership transition to occur.

On the other hand, if you’ve built the company from the ground up and have been a necessity since its formation, management succession will be more difficult. Because your presence is mandatory for the business to operate, the risk associated with your departure will drive down the value of the business.

Consider asking yourself these questions to get a sense of how valuable you are to your business.

In some instances, the owner decides they want some liquidity, but still want to be involved in management.

This is known as a partial sale and is ideal for owners looking to get out of the day-to-day responsibilities, but still play an important role going forward.

It can also be an exciting option when a business owner is seeking help in addressing potential growth opportunities - a concept known as growth support.

Growth support allows small business owners to raise capital while acquiring a strategic and financial partner to assist in realizing the business’ growth potential. This is more of a phased approach to an eventual exit, allowing business owners to take “a second bite of the apple” before seeking a complete exit.

Family Transition

The sale of a family business from one generation to another is an excellent opportunity to achieve liquidity while keeping family members involved in the business.

A family transition has the ability to not only give family owners liquidity but achieve the often competing needs of family businesses:

- Retained family ownership;

- Ongoing employment for family members;

- Distribution of sale proceeds among active and inactive family members;

- Family legacy in the community;

- Management succession between generations;

- Potential introduction of non-family management.

See how we approach these considerations.

Family transitions can often be a double-edged sword, especially when multiple generations are involved. Trying to please everyone in an exit strategy can be difficult, and if improperly managed, lead to the destruction of family relations.

Another consideration to keep in mind is whether a transition can be achieved without external funds. Owners frequently come to us seeking financing because the family doesn’t have the necessary capital to complete a multi-generational ownership transition.

Partnership Buy/Sell

It is common for business partners to have different retirement horizons. When one decides to move on and the other wants to stay, a partnership buy/sell agreement can be an optimal exit strategy. Essentially, this agreement allows you to retire and your partner to take over the company.

Additional benefits of a partnership buy/sell include:

- It provides assurance for the future of the company;

- There isn’t another buyer that knows your business as well as your partner;

- Selling to your partner ensures a competent buyer who understands the industry, market, customers, etc.

The biggest problem we see during this process is liquidity: one partner wants to sell their stake, but the other doesn’t have the financing to buy their partner's stake.

A common solution to this is the issuance of a seller note.

A seller note is a form of financing in which the seller agrees to take the purchase price in a series of payments. Seller notes act like debt in the sense that they get paid back over a maturity date and have associated interest. We’ve gone in-depth with seller notes.

Sell to Management Team

This approach offers the same overall benefit of a partnership buy/sell agreement: leaving the business in the hands of an experienced team and achieving some liquidity.

Much like a partnership buy/sell agreement, a seller note is a common form of financing used to fund the acquisition of a business from an owner by a management team. That is, the owner/seller issues a note to the management team to “fund” the purchase.

A potential downfall in this strategy is that the owner/seller will lack control of the company and its strategy going forward. Management teams might choose to pursue different growth initiatives following the sale. While this isn’t necessarily a bad thing, it can become problematic given the “series of payments over time” aspect of a seller note. A seller’s future liquidity is dependent on the success of the management team’s performance.

Other Exit Strategies

Selling your business tends to be the most common approach for small business owners seeking an exit; however, alternative strategies may align with your vision.

Employee Stock Ownership Plan

An Employee Stock Ownership Plan (“ESOP”) allows a business owner to sell all, or a portion, of their business to their employees. The cash proceeds from the sale are then transferred to the owner, generating liquidity and formalizing the owner's departure from the business.

An ESOP is not a traditional corporation (S Corp, C Corp, LLC). It is a tax-favored trust fund that serves as an employee benefit plan. One purpose of an ESOP is to incentivize employee performance through stock-based compensation.

From a business owner’s perspective, creating an ESOP can be ideal if you’re looking to grow the company with current employees. Aligning employee interests with shareholder interests can lead to greater employee engagement, increasing the chances of future success.

Owners who pursue an ESOP also enjoy the benefit of not having to find a buyer. This can be especially helpful if you want to avoid a sale process or if your management team doesn’t have the financing to buy you out.

While this can be an effective exit strategy, there are potential issues that can harm the operational flexibility of the business, such as repurchase obligations, legality concerns, and strict regulations. Read more on these issues here.

Merger

Merging is the process of “uniting” with another company to form a single entity. The transition entails a voluntary agreement between firms who operate in the same industry, are roughly the same size, have similar customers, etc.

This is the ideal scenario if you find a compatible company whose interests and operations align with your own. A successful merger can help realize benefits between companies, boost market share, and improve overall efficiency. In other words, 1+1=3.

Investopedia has written at greater length on what to look for in corporate mergers.

One of the biggest problems with this strategy is the time and dedication involved in making it work. Owners who decide to merge are often more focused on the long-term potential of the company rather than using it as a means of exiting their business in the short term.

Going Public and Liquidation

These strategies are much less common small businesses exit strategies.

Going public involves an Initial Public Offering (“IPO”), a process in which new shares of the company are issued to the public.

Once completing the lengthy process, your business will have to abide by a new set of regulations, management will have to align with stakeholders’ interests, etc. Ultimately, you forfeit control of the company to the public. It’s a very expensive process and not a good fit for small company exit strategies.

Liquidation is usually the outcome of a business not performing well.

This exit involves ending the business and distributing its remaining assets accordingly. Unfortunately, though undesirable, this happens to companies often. When a company is unable to pay back its dues, owners will liquidate their business to get a sense of closure.

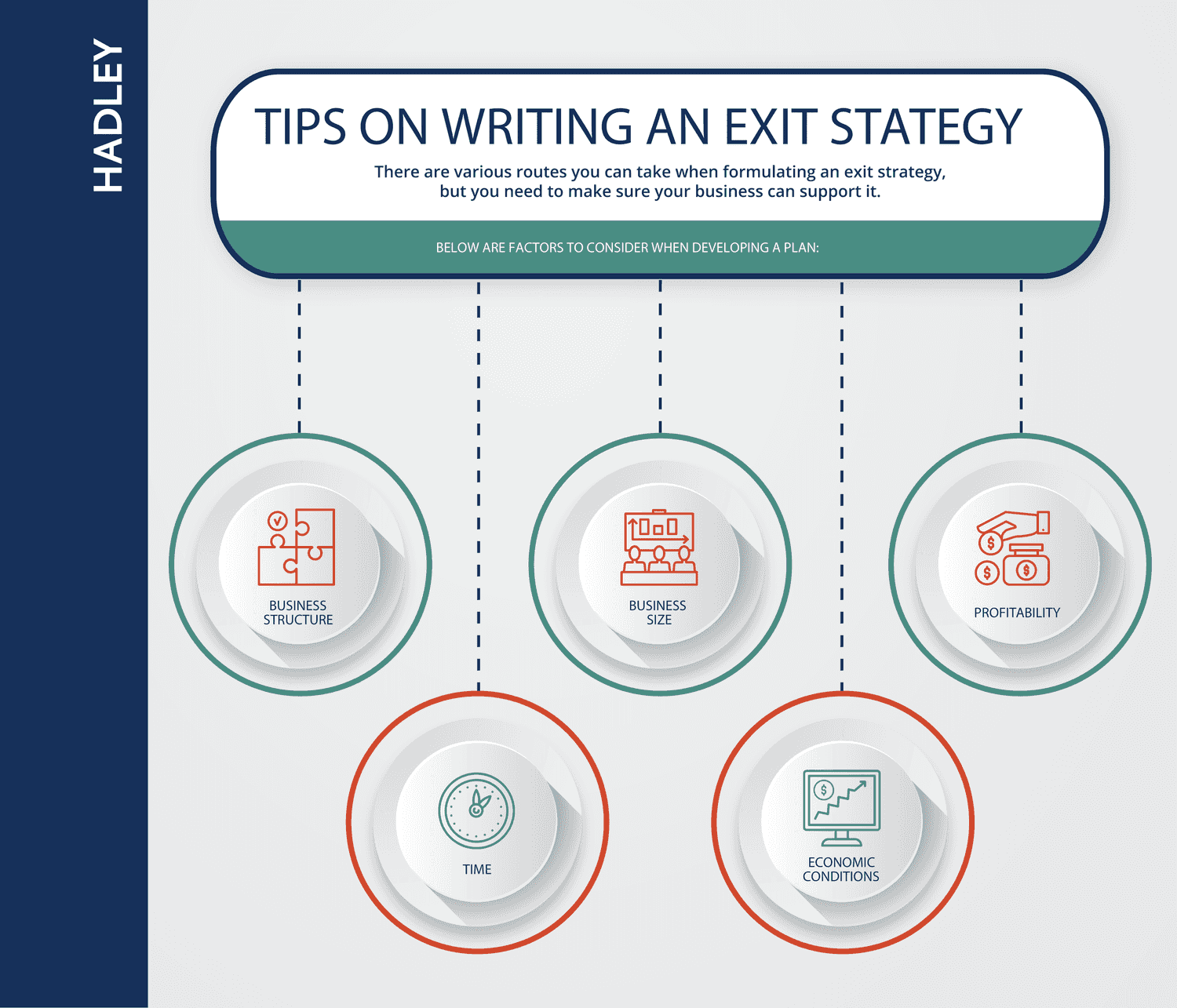

Tips on Writing an Exit Strategy

When formulating an exit strategy, there are many factors to consider:

Seek guidance from trusted advisors, including accountants, attorneys, fellow business owners, friends, family, etc. Just remember an ideal exit strategy should be tailored to YOUR needs and desires; approaching the process with this mindset will ensure an optimal outcome.

Conclusion

You have put decades of work into your business. Putting together an exit strategy is the first step in protecting the future of your business and achieving the best outcomes for you.

Hadley has acquired and assisted companies seeking this, tailoring each approach to the owner’s unique situation.

If you are contemplating the appropriate exit strategy for you and your business, please contact us.