Entrepreneurship through Acquisition (ETA) is the path to becoming an entrepreneur by buying and growing an established small business.

For individuals with business skills and a desire to make a meaningful impact, this can be less risky than starting a new business around an unproven product or service.

ETA is typically pursued later in a person’s professional life after they gain operational experience and a more robust professional network. Over the past two decades, ETA has become a more well-trodden career path.

In fact, ETA is now a common curriculum option at many graduate-level business schools. We called on our friend Professor Mark Smith, Ph. D, lecturer at the University of Illinois, to help us develop an outline for this blog post.

This blog post will cover the basics about entrepreneurship through acquisition, various ETA models to consider, and other important considerations including deal flow and time commitment:

- Small Business and ETA

- Ideal ETA Targets

- Self-Funded Search Fund Model

- Traditional Search Fund Model

- Sponsored Search Fund Model

- Incubated Search Fund Model

- Crowd-Funded Search Fund Model

- Deal Flow

- ETA Time Commitment

Small Business and ETA

Small business and ETA go hand-in-hand because there are a lot of small businesses in need of ownership transition and management succession and the capital required to acquire a small business is lower.

ETA is the beneficiary of a major demographic trend in the United States: more than 40% of all small businesses are owned by baby boomers. These baby boomer business owners are in need of management succession and ownership transition.

And, a recent survey by Wilmington Trust suggests that nearly 60% of boomers do not have a succession plan.

We’ve also written at greater length on baby boomers and succession planning.

Enter ETA.

ETA searches tend to focus on small businesses because access to investment capital is often a meaningful constraint for ETA candidates.

This influences the size and type of business targeted for acquisition.

But, with more than 30 million small businesses in America, how does an ETA searcher focus their limited time and resources?

Ideal ETA Targets

There are three high-level factors that come into play in a typical ETA search process: business characteristics, target industry, and geography.

The characteristics of an ideal small business acquisition candidate for Hadley are similar to those of an ideal ETA target:

Beyond the characteristics of the ideal business, a target industry is another consideration and can vary widely.

Though Hadley is generally industry agnostic, ETA searchers may find that developing an industry focus (and expertise) is helpful in two important domains:

- quickly evaluating potential acquisition candidates

- differentiating themselves in a competitive acquisition process.

Geographic focus may also be a significant consideration, particularly for someone later in their career or with important family considerations (kids in high school, for example).

While a geographic preference can help focus the search, it can also introduce an extremely limiting element to the search.

Generally, the tighter the geographic circle, the smaller number of potential acquisition candidates.

And, since the odds of any potential acquisition candidate turns out to be “the one” are extremely small (more on this below), the challenges of a tight geographic preference become more acute.

But, before beginning a search for a business, in a target industry, and specific geography, most ETA candidates need to evaluate which ETA model is best suited to their needs and goals.

There are several ETA models used for small business searches and acquisitions, let’s start with the most common:

Self-Funded Search

The self-funded search is just that, self-funded, and is the most common search model.

Self-funded search is also often referred to as a “fundless sponsor”.

That is, an individual looking to “sponsor” an acquisition but without the “funds” to complete it without support from a third party. Here we’ve written at greater lengths on private equity vs. fundless sponsors.

The entrepreneur bears all the costs to find a suitable acquisition target. Once a business is found to purchase, the entrepreneur determines the best funding strategy for the acquisition.

Deals are funded by a combination of personal funds, investor capital, seller financing, and bank financing.

Nearly all small business acquisitions in any given year start as self-funded searches.

Based on the most recent data from Mark Smith’s ETA course, it is estimated all other search models account for less than 100 acquisitions per year.

Hadley interfaces with dozens of self-funded ETA searchers (also synonymous with “fundless sponsors”) every year.

We have identified three important elements that a fundless sponsor or self-funded ETA search can bring to a potential acquisition opportunity:

- Identifying a proprietary acquisition opportunity

- Negotiating a value purchase price

- Contributing meaningful operating experience.

Learn more about these three elements and how we think about working with self-funded searchers.

Traditional Search Fund

In the traditional search fund model, capital is raised from investors to fund the search phase.

Expenditures in the search phase include searcher salaries, office space, travel expenses, and due diligence costs for a period of up to two years.

Investors typically receive preferred equity in the acquisition equal to 1.5x their investment.

They also typically receive the right of first refusal to invest additional capital in the acquisition.

Tom Matlock, an Investor and CEO writes more about what he looks for in a search funder in his article “Defining Industry Boundaries for a Search Fund”. Below is a small preview of what he says:

“What I’m really listening for is how the search funder thinks about the industry.

What sectors do they find attractive and why?

How are those sectors related in any way to their past experience, their network, the things that they have already done?

How do they think about generating deal flow in these sectors?

What are they actually planning on doing, when they hit the ground, to start the process that they hope will end with them buying a company and becoming CEO?”

Although ETA search funds have become much more accepted in the alternative investing community, finding the right investor can still be a challenge.

Search Fund is a good resource to start the search for investors.

Starting a traditional search fund can be a daunting process, but luckily there are resources available to simplify the process.

Stanford Business put out an article to do just that in “What it Takes to Be a Search Fund Entrepreneur” where they discuss that sometimes, rather than starting your own business, it can be simpler to acquire another.

Sponsored Search

A sponsored search involves the searcher partnering with an investment firm (family office, a private equity firm, etc.).

The firm provides all the capital for both the search and the acquisition and is, therefore, the controlling shareholder.

The firm provides the searcher office space, administrative support, and/or infrastructure to conduct the search.

As the controlling shareholder, the firm will control the Board of Directors.

Hadley works with experienced industry executives in a hybrid version of the sponsored search model. In this case, Hadley provides our industry executive partners with access to our proprietary buyside relationships that can help quickly identify target companies for sale and facilitate introductions to owners.

Our industry executive partners provide the industry knowledge and expertise that separates us (as a team) from other potential buyers.

Once a target is identified, Hadley then provides resources to evaluate the target, conduct due diligence, and complete the acquisition.

In addition, Hadley provides the bulk of the equity financing to complete the acquisition.

At any time, we have at least one or two of these hybrid sponsored searches in process with experienced industry executives.

In fact, I am currently working on a hybrid sponsored search in the sporting goods industry.

If you are an experienced industry executive that is interested in pursuing an acquisition opportunity in your industry, and you need a good partner, please reach out to me to learn more about how Hadley can be helpful to you.

Incubated Search

An incubated search is similar to a sponsored search in that the searcher has committed capital for the search and acquisition.

The difference is the searcher has office space with other searchers and benefits from shared search infrastructure, administrative support, and daily interaction with other searchers.

The infrastructure and support are geared towards helping searchers and the incubator handles all the recruiting and hiring of search interns. Searchers share a database of potential acquisition targets.

Crowd-funded Search

The crowd-funded search is where the entrepreneur raises capital for the search and acquisition from crowdfunding sources.

Search capital can be structured as preferred shares and/or convertible debt.

Acquisition capital can be structured as common shares, preferred shares, or a combination with different liquidation preferences, PIK rates, etc.

The Evolution of Entrepreneurship through Acquisition is another great resource to learn more about the various ETA models at length.

Deal Flow

Once the ETA search has commenced, the focus turns immediately to identifying potential acquisition opportunities.

In industry lingo, this is referred to as “Deal Flow.”

Earlier this week I talked to an ETA searcher trying to identify and acquire a small manufacturing business in Michigan and heard a common refrain: “I need more deal flow.”

Though it might appear that determining the best ETA model to pursue or identify investors is the most challenging aspect of ETA, by far the most challenging is deal flow.

Even more confounding is that deal flow represents a strange paradox: there are a huge number of small businesses in America and many of them are in need of management transition and ownership succession but identifying the best opportunities can feel like searching for a needle-in-a-haystack.

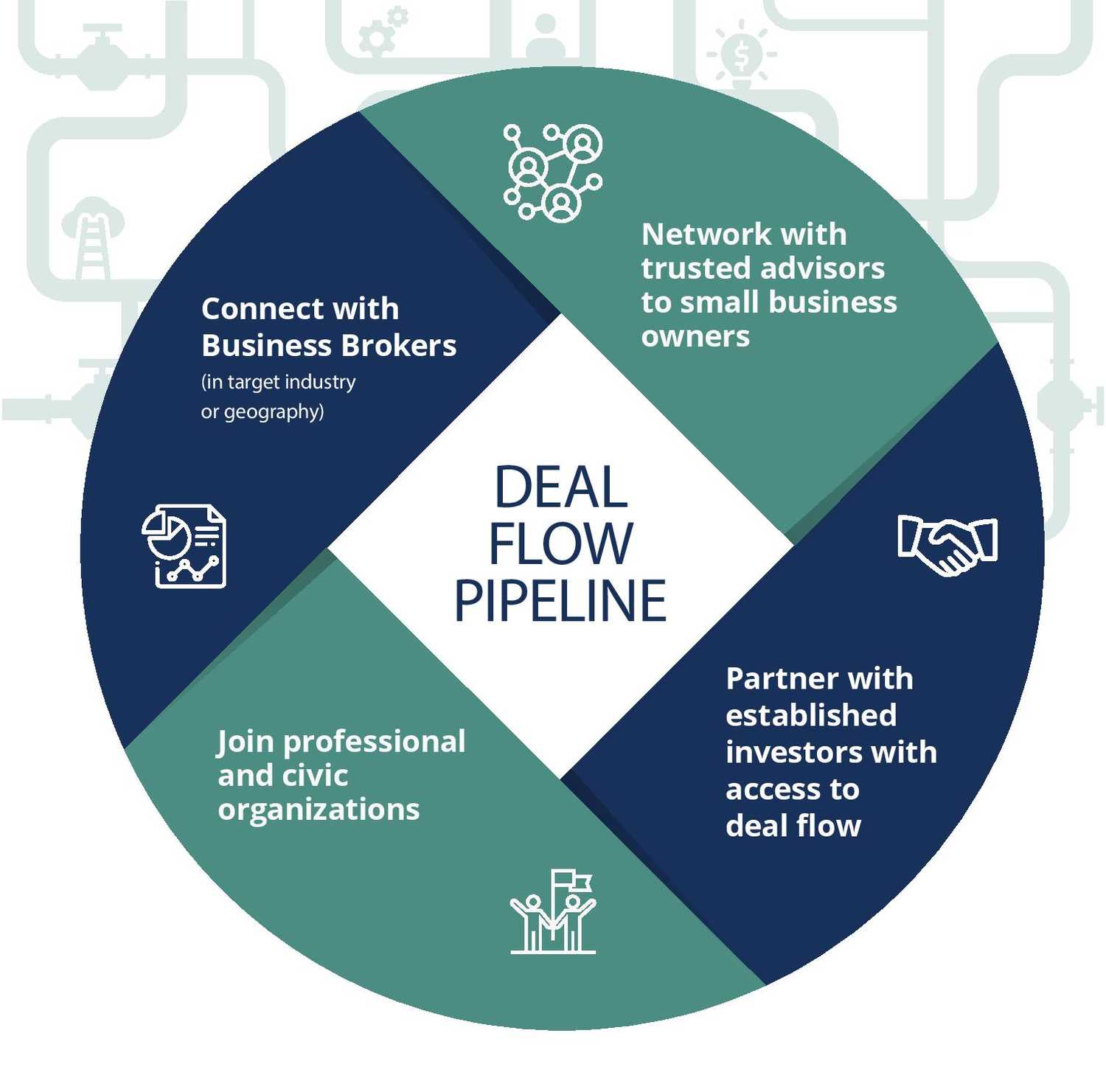

Developing a robust deal flow pipeline will quickly become the number one focus of any ETA search.

As previously mentioned, developing specific criteria (business characteristics, industry, etc.) can help focus the search.

But, criteria that are too specific can quickly narrow the search to a level that will lead to a dramatic decline in deal flow.

There are a number of places to get started in developing a strong deal flow pipeline.

Take a look at the infographic below to learn more:

Deal listing sites such as BizBuySell, BizQuest, and Axial can also be a good way to prime the deal flow search process.

Hadley has been in the small company acquisition market for nearly 20 years and our deal flow pipeline is robust.

As a result, we review thousands of acquisition opportunities every year yet we aim to acquire 1 - 2 companies per year.

With this level of yield, it becomes extremely apparent how important deal flow is to a successful ETA outcome.

And, it also influences the time commitment that someone needs to commit to ETA in order to be successful.

ETA Time Commitment

I talk with potential ETA searchers almost every month - from experienced industry executives, post-MBAs, and buddies considering a career change.

I am frequently asked, “How long should I expect this process to take?”

My answer is often sobering - it’s two years...and that’s if you are doing it full time.

Hadley’s experience in acquiring small businesses is that it takes nearly one year, on average, from introduction to a small business owner considering a sale to actually closing the acquisition.

And, as I said above, we have a robust deal flow pipeline.

For an ETA candidate starting from a standing start, it would require him or her to identify an acquisition candidate within the first year of the search and then complete the necessary due diligence, organize the financing, get the legal done, etc.

Assuming the deal doesn’t fall apart at any stage of the process, which is not uncommon.

Entrepreneurship through Acquisition (ETA) is an exciting path to becoming an entrepreneur by buying and growing an established small business.

Achieving a successful ETA outcome requires a lot of hard work and discipline but the potential rewards can be well worth the effort.

I’ve included a list of books that go into greater detail about entrepreneurship through acquisition. You can view them at the links below.

- Buy then Build by Walker Deibel

- HBR Guide to Buying a Small Business by Richard Ruback & Royce Yudkoff

- Here’s the Deal by Joel Ankney

If you’re actively pursuing entrepreneurship through acquisition and are looking for an experienced partner, feel free to email us at info@hadleycapital.com.